Some Known Details About Eb5 Regional Center Program

Table of ContentsThe Best Strategy To Use For Eb5 Regional Center ProgramHow Eb5 Regional Center Program can Save You Time, Stress, and Money.Eb5 Regional Center Program Can Be Fun For AnyoneSome Ideas on Eb5 Regional Center Program You Should KnowGetting My Eb5 Regional Center Program To Work

First, the program is placed in an extremely strange and non-helpful bureaucratic location for the excitement of international investment in the United States. Second, its scale is all incorrect. We are distributing excessive for as well tiny of a financial investment. Further, increasing equity capital half a million dollars a tranche is, to state the least, inefficient.

Perhaps that is just one of the factors why it has actually stopped working every year to get to the legal objective of 10,000 financial investment visas. Fifth, the Regional Center Program is inherently awkward, and the program is too filled up with intermediaries, both public and private. The program has more than its share of rumors, which I will get right into later on if anyone is interested.

This is an agency that loves to claim yes to applicants, yet as the table in my testament reveals, USCIS police officers have a lot more trouble with EB-5 applications than others. I think that is something that no one has actually truly chatted about much. EB5 Regional Center Program. There are high rates of internal denials in this program and forever factor

Eb5 Regional Center Program Can Be Fun For Anyone

Seventh, in this program visas go to individuals that could not get them differently and to individuals whose organized investment is really much less, according to the Federal Reserve, than the average mean total assets of all American family members in 2007. Allow me increase on among my monitorings.

My estimate based upon the investors' eco-friendly card applications submitted 2 years after the initial financial investment-- these are the solid ones that stay and are authorized. This is 2009-- was that they had regarding $191 million validated-- that is my quote. USCIS does not give the type of information that we might utilize on this.

So for every single $100 of raised foreign investment that year, the EB program contributed one penny. Under a much a lot more unsteady statistical base, the preliminary applications of would-be immigrant capitalists, USCIS is telling journalists that the level of financial investment in the just-concluded year had to do with $1.2 billion. Let us accept that.

9 Easy Facts About Eb5 Regional Center Program Explained

Thanks for listening to me. I anticipate your remarks and concerns. [The ready statement of David North shows up as a submission for the document.] Chairman Leahy. Thanks. Our following witness is Robert Divine. He is an investor of Baker, Donelson, Bearman, Caldwell, and Berkowitz. He is the head of the company's migration practice group.

Divine worked as Chief Guidance of the United States Citizenship and Migration Solutions from July 2004 up until November 2006, the year in which he was go to this site Acting Supervisor, and afterwards Performing Replacement Director. He has functioned extensively with the EB-5 program secretive method. He was elected, as I recognize, vice head of state of the Organization to Invest in United States, the national industry organization of regional centers.

STATEMENT OF ROBERT C. DIVINE, LAWYER, BAKER, DONELSON, BEARMAN, CALDWELL, AND BERKOWITZ, P.C., CHATTANOOGA, TENNESSEE, AND VICE PRESIDENT, INVEST IN THE U.S.A. (IIUSA) Mr. Divine. Thank you, Mr. Chairman, Senator Grassley, and others.

At most, if all 10,000 slots were utilized, it would certainly be 1 percent of the immigration yearly to the United States. It is not near that yet, yet it is expanding and obtaining toward that. Specifically as USCIS, the company that oversees the program, has been making the guidelines clearer and the processes extra sensible and clear for individuals who are organizing financial investments and for the capitalists who are investing, more people have actually been ready and able to put effort and cash right into the process to find excellent tasks and establish them, and after that extra capitalists have been prepared to spend their money and take the threat and use the money to create the work that is the factor of the program.

All about Eb5 Regional Center Program

These projects do not wait about for life, and USCIS comprehends that and are trying to speed the program, speed the process - EB5 Regional Center Program. That does not mean that they are unwinding their analysis, and, as a matter of fact, they are ready to reject applications that are not certifying. And they do so, as was stated

The process takes a good while to develop a task and after that to get the investors approved. And they do not want their money streaming through up until they have actually been authorized. And the specter of the expiry of this Regional Facility Program in September is currently inhibiting the advancement of jobs.

Getting My Eb5 Regional Center Program To Work

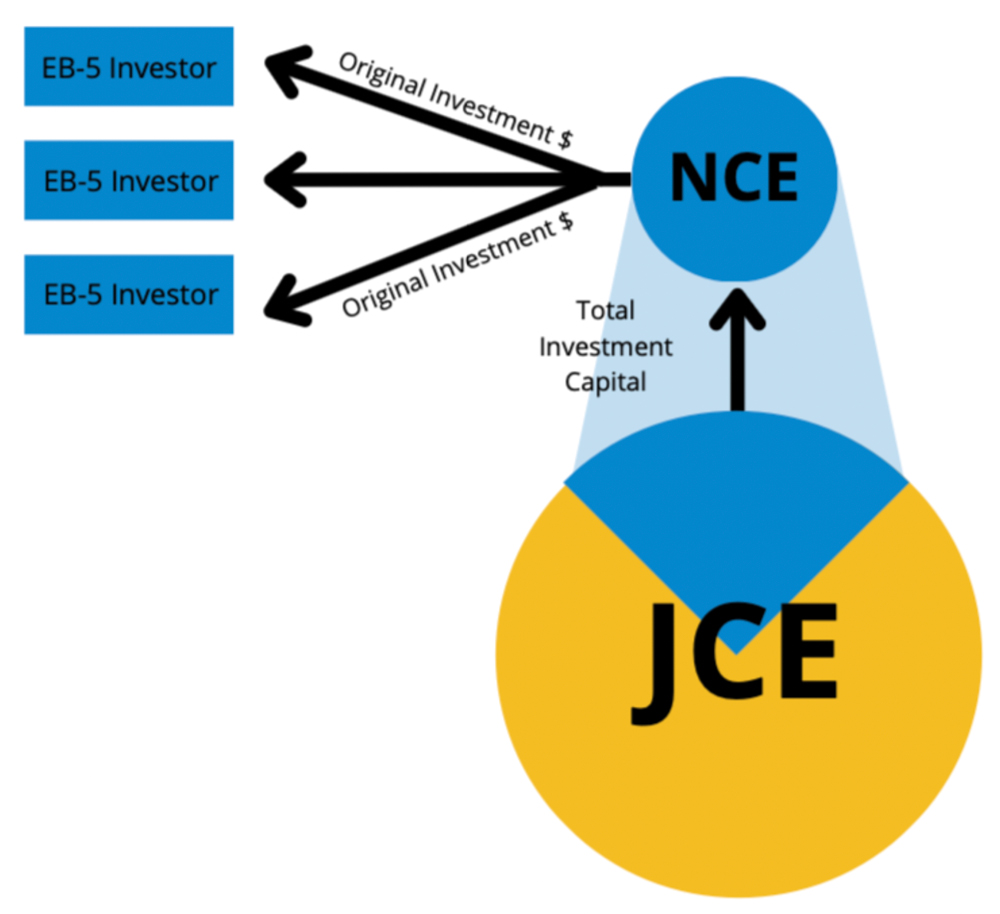

I would certainly like Full Article to clarify that the Regional Center Program is not the very same as read here the half-million-dollar point. The concept of half a million or a million is a function of the normal EB-5 law that is part of the code. It just is a fact that many of the local centers that are merging financial investments have actually established those in areas of high unemployment or in backwoods where fifty percent- million-dollar financial investments are permitted, and that makes good sense.